Animal agriculture markets resilient almost a year into COVID-19 pandemic

Texas A&M center cooperates on studies examining costs to producers, consumers

As vaccination efforts expand and the economy begins showing signs of recovery, Texas A&M AgriLife personnel are tabulating the impacts of COVID-19 on the U.S. animal agriculture product market. Leading the effort is Texas A&M University’s Cross-Border Threat Screening and Supply Chain Defense, CBTS, Department of Homeland Security, DHS, Center of Excellence.

The two recent contributions to that effort specifically examine the impacts on livestock, meat, poultry and dairy product markets, and what that means for producers and consumers, said Greg Pompelli, Ph.D., CBTS director.

“We want to gain a clearer picture of the pandemic’s short and longer-term impacts on the U.S. food and agriculture sectors in comparison to other critical sectors,” Pompelli said.

CBTS-funded researchers at the Food and Agricultural Policy Research Institute, FAPRI, at the University of Missouri are examining the impacts of the COVID-19 pandemic on agricultural commodities, food and related supply chains.

Additionally, CBTS joined forces with Arizona State University’s Center for Accelerating Operational Efficiency DHS Center of Excellence and researchers at the Victoria University in Australia to determine how COVID-19 mitigation costs in the meatpacking plants might have affected retail meat prices and the prices received by livestock producers.

Surprising, expected results in animal agriculture market

These two efforts have identified impacts consistent with prior expectations, as well as some surprises. The assessments indicate that COVID-19 presented circumstances that could not have been predicted prior to experiencing the pandemic, Pompelli said.

When meat packing plants suspended or slowed operations due to COVID-19 outbreaks among workers, these disruptions contributed to sharp increases in the processing cost of consumer-ready meat products. The expectation was that these costs would be borne both by livestock producers and meat consumers.

While the contracting U.S. economy was expected to reduce disposable income and cause consumers to buy less meat and other high-value food products, that didn’t end up being the case, according to FAPRI’s assessment of USDA data.

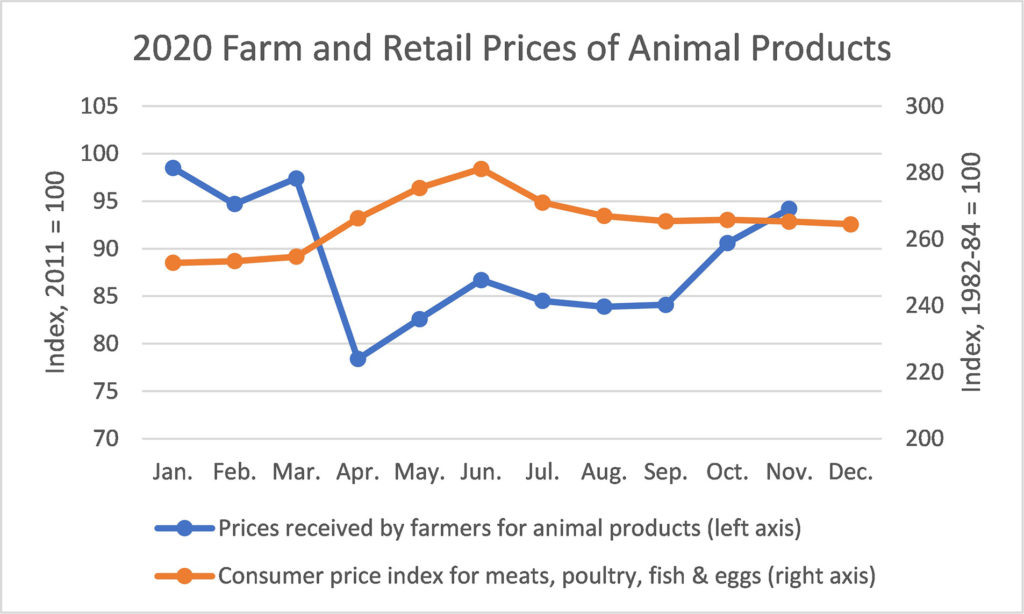

Farm prices for livestock and animal agriculture products did decline sharply in the spring, but apparently, supply chain issues were the primary cause, not macroeconomic effects.

“Consumer meat prices increased by more than 6% in 2020, while domestic per-capita meat consumption also increased slightly,” Pompelli said. “This is one of the surprising outcomes for a year in which the pandemic’s disruptions and negative impact on the domestic economy signaled a weak outlook for livestock producers.”

Watching the market

The USDA data show that the average price paid to livestock, poultry and dairy producers at the farm level dropped by almost 20% in April. At the same time, consumer prices for meat, poultry, fish and eggs began a sharp increase in April, and by June, consumer prices were more than 10% above the March level.

But, according to the USDA data, when the packing plant disruptions subsided and other supply chain problems were resolved, the trends reversed.

“We would have expected to see reduced domestic consumption of meat and/or lower retail prices,” Pompelli said.

The data also show consumer prices for meat and other animal products actually declined by more than 5% between June and November, while farm-level prices for animal products increased by 20% between April and November.

And while real GDP contracted sharply in 2020 in the U.S. and many other countries, real disposable income actually increased significantly because of various government stimulus programs.

Increased spending on the Supplemental Nutrition Assistance Program and the new Food Box program from USDA directly subsidized food consumption. Also, restrictions on restaurant indoor dining resulted in major changes to where consumers purchased their food and what food they purchased.

“While things are not back to their pre-COVID stages in the sector — consumers are still paying slightly higher prices — we can say the situation has improved dramatically since the depths of the crisis last spring,” Pompelli said.

Report: Consumers will help pay for meat-processing employee safety measures

The second CBTS-involved study with researchers in Arizona and Australia focused on: If changes in work practices introduced to reduce the spread of COVID in U.S. meat-processing plants remain in place, who will pay for them?

Meat-processing plants saw a rapid spread of the COVID-19 virus in the early months of the pandemic, which led to increased, when possible, distances between workers, improved hygiene measures and the installation of separation barriers. These changes increased costs per unit of meat processed.

For this study, researchers used the USAGE-Food model to simulate the impact of a permanent 10% increase in the labor and capital investment costs for meatpackers. Although the exact percentage is not known at this time, the 10% figure is considered to be higher than actual costs. As such, it serves as a worst-case scenario to illustrate possible impacts.

The USAGE-Food model depicts the U.S. economy across 392 industries, including beef, hogs and poultry processing, related industries, cattle ranching and other animal farms — mainly hogs, and poultry and egg farms.

Contrary to expectations, the USAGE-Food simulations showed that when processing costs increased, the additional costs are paid mainly by meat consumers, not farmers.

For example, a 10% increase in beef processing raises the price of beef products in supermarkets by 1.488% relative to the general consumer price level. Similarly, 10% increases in pork and poultry processing raises the prices of these products sold to households by 1.444% and 1.673%, respectively, relative to consumer prices in general.

Farmers and ranchers were able to avoid over 80% of extra processing costs because they have alternative markets, including direct exports of farm products, replacement of imported farm products, and direct sales of farm products such as eggs to households, the report concluded.

This finding does not mean that livestock producers can avoid extra processing costs entirely, Pompelli said. Instead, they can avoid some of these costs on the margin, especially if they can shift marketing channels where less processing is required.

In the end, he said, simulating the effects of 10% increases in labor and capital requirements in processing showed a negative impact on farm incomes of only 1-2.5%. And the effects on the macroeconomy of these large, simulated increases in processing costs are minor, only reducing GDP in the long run by about 0.03%.

Looking forward

While questions remain about how markets for meats and other animal products will evolve in 2021 and beyond, the largest COVID-related supply chain disruptions appear to be waning. However, according to the FAPRI assessment, forecasters expect GDP to rebound, but the eventual decisions about stimulus programs could affect disposable income and food demand in 2021.

Finally, as the risk of further pandemic disruptions fades, livestock producers still face longstanding risks, including sharply increasing feed prices due to lower-than-expected crop production in the U.S. and South America, Pompelli said. These changes in feed costs will eventually affect livestock sector production and consumer prices for meat and other animal products.

“The fact that livestock producers weathered the worst the pandemic had to offer in 2020 is great news,” Pompelli said. “But the rising feed costs remind us that agricultural producers face a wide variety of risks every year in their business, and those aren’t going away, just changing.”

a. Acknowledgement. This material is based upon work supported by the U.S. Department of Homeland Security under Grant Award Number 18STCBT00001.

b. Disclaimer. The views and conclusions contained in this document are those of the authors and should not be interpreted as necessarily representing the official policies, either expressed or implied, of the U.S. Department of Homeland Security.